all-about-investments

Learnings Investments

Before going forward, consider giving this repo a

star⭐ because it’s a promise that I’ll give you all the knowledge I have about investments which can help you a lot!

If you’re not investing your money, you’re basically losing it! There’s no such concept of “saving” money because the money that you keep aside as your savings will decrease it’s purchasing power over time due to inflation.

You must have heard this from a few places, even I did but I never understood the true meaning until I actually played with some numbers.

Inflation adjusted purchasing power

Ok, so let’s assume you have 100,000 INR in your bank account. You’re not investing it anywhere, just keeping it in your bank account. Now, let’s assume the inflation rate is 5% per year.

Now 5% is not a fixed value, sometimes it’s much higher, sometimes it can be lower. Also, inflation can be different in different segments. Some segments have higher inflation rates than others - so you might be facing an inflation rate that is much higher than 5%, but for now, let’s stick to 5%.

- After 1 year, youe

100,000will decrease it’s purchasing power to95,000. - After 2 years, it will be

90,250. - After 3 years, it will be

85,737.5. - After 4 years, it will be

81,450.625. - After 5 years, it will be

77,378.094. - After 6 years, it will be

73,509.189. - After 7 years, it will be

69,833.729. - After 8 years, it will be

66,342.042. - After 9 years, it will be

63,024.94. - After 10 years, it will be

59,873.693.

So, if you try to “save” your money, it will actually reduce to almost half of it’s value within the next 10 years. And, this is assuming that the inflation will be just 5%, in reality, inflation can be much higher than 5%.

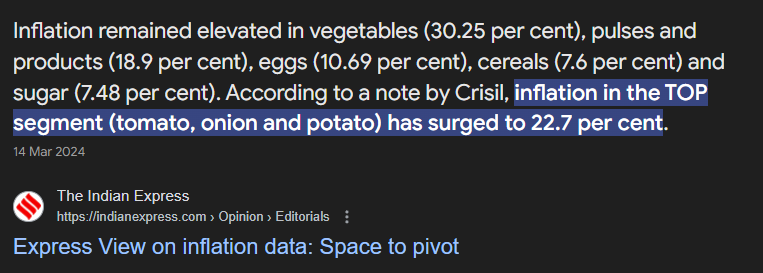

Let me give you a picture of Segmental Inflation, let’s come to the basic needs - food. Let’s see what was the inflation rate for basic food items in India:

And, if this doesn’t scare you, I don’t know what will.

Why I regret starting so late

Being from an Indian family (I’m going to generalize here a bit), we’re not taught about investments. We’re taught to save money, keep it in the bank, and that’s it.

Now saving money is important, and most banks (in India) will give you an interest rate of around 3% on savings account and 5-6% on fixed deposits.

To be honest with you, that’s not a bad deal, that’s good enough to almost stay near inflation levels and not lose much of your purchasing power. But, that’s not the best deal either because most of the times these interest rates will be lower than inflation levels! (plus the crazy taxes)

I never cared about investments, until I started reading about stock market.

Let’s just take a look at the returns of Nifty 50 index in the last 5 years!

In just 5 years, the index has given a crazy return of 120%!!

Do you know what it means? If - you would have put that 100,000 INR in the Nifty 5 years ago, it would have been 220,000 INR today! 🤑

The sad part is - I did not do that, and I missed the most golden time of Indian stock market.

Year 2022 - 2024 has been a continuous bull run (meaning, majority of investors are buying in the market causing the value of stocks to touch higher highs continuously).

Now, let’s just assume for a moment that instead of exact 5 years, if you put that 100,000 INR in the Nifty 50 index during the Covid-19 market crash where the Nifty touched a low of around 8,000 points, your money would have become 3x today given that Nifty 50 is above 24,000 points! 🤑

Now that looks too good to be true - 100,000 worth of investment becoming 300,000 in just 4 years!

But that’s what I said - 2020-2024 has been a golden time for Indian stock market.

- Will it continue to give such good returns? I DON’T KNOW - NOBODY KNOWS

- Is it safe to invest right now? I DOn’t KNOW - NOBODY KNOWS

- Will the market crash again? I DON’T KNOW - NOBODY KNOWS

- Will the market go up? I DON’T KNOW - NOBODY KNOWS

There is a possibility that market might go up and down, or it might not give as good returns. But the regret of not having the knowledge of investments and not investing in the market when it there was a golden time is what inspired me to create this repo to document whatever I learn so that others can learn from my knowledge and take informed decisions when it comes to stock market and investments, and use this knowledge to grow their wealth.

A HUGE HUGE DISCLAIMER!!!!

None of the examples that I’m going to share in this repo are stock buying or selling recommendations, neither do I take any money from any company to promote it’s stock in this repo, nor I have any intention to promote or defame any firm.

This repo is just for learning and the examples that I might use are ALSO intended JUST FOR LEARNING! Most of the examples might be of randomly picked companies, so if you decide to invest in that company just because this blog takes an example of that company - that’s foolish and defeats the main purpose of this blog, i.e, to learn about investments.

Table of contents

- Fundamental Analysis

- Technical Analysis: To be added soon

Special mentions

Here are a few places from where I’m learning about investments, this blog is more or less the summary or important notes from these courses. Do check these out: